Is cancer in the cards for you?

Recent findings in nutritional studies have debunked much of the conventional wisdom we accepted as children. Effective dieting, as an example, is not practicing until you lose the weight but should be a lifestyle you maintain so that weight doesn't waffle. Most of the foods we eat are the cause of both medical and cognitive issues. We gain the weight because of the seductive foods we eat that cause our #wheat belly. The dementia grandpa has and the ADHD little Johnny has both come from the consumption of grains. Finally, the refined processing, chemical additives, and GMO's we consume rob us of our nutrients and eradicate our immune system providing a breeding ground for carcinogenic growth. Review my suggested reading for more information.

Yet, most people think they are resilient or impervious to health issues until it happens to them. Until we come face to face with cancer in a loved one, in a state of denial we tend to be. Virtually no one stops to think of the financial impact cancer will have until they are trapped.

The statistics are alarming! According to the National Cancer Institute, the impact in the U.S. is shocking.

- "In 2016, an estimated 1,685,210 new cases of cancer will be diagnosed in the United States and 595,690 people will die from the disease.

- The most common cancers in 2016 are projected to be breast cancer, lung and bronchus cancer, prostate cancer, colon and rectum cancer, bladder cancer, melanoma of the skin, non-Hodgkin lymphoma, thyroid cancer, kidney and renal pelvis cancer, leukemia, endometrial cancer, and pancreatic cancer.

- The number of new cases of cancer (cancer incidence) is 454.8 per 100,000 men and women per year (based on 2008-2012 cases).

- The number of cancer deaths (cancer mortality) is 171.2 per 100,000 men and women per year (based on 2008-2012 deaths).

- Cancer mortality is higher among men than women (207.9 per 100,000 men and 145.4 per 100,000 women). It is highest in African American men (261.5 per 100,000) and lowest in Asian/Pacific Islander women (91.2 per 100,000). (Based on 2008-2012 deaths.)

- The number of people living beyond a cancer diagnosis reached nearly 14.5 million in 2014 and is expected to rise to almost 19 million by 2024.

- Approximately 39.6 percent of men and women will be diagnosed with cancer at some point during their lifetimes (based on 2010-2012 data).

- In 2014, an estimated 15,780 children and adolescents ages 0 to 19 were diagnosed with cancer and 1,960 died of the disease.

- National expenditures for cancer care in the United States totaled nearly $125 billion in 2010 and could reach $156 billion in 2020."

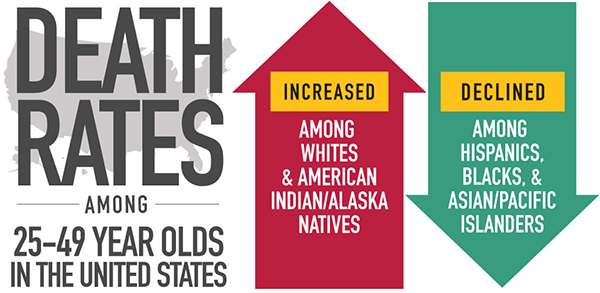

- It is necessary to note, while in some cancer death rates declined, in others, it increased.

Regardless of who gets cancer, the financial burden of cancer care can be devastating. In a survey by the AOSW, Association of Oncology Social Work: "66% of patients with major financial challenges suffer depression or anxiety, 29% delay filling prescriptions due to financial pressures, and 22% skip doses of their medications. Sixty-three percent of oncology social workers surveyed said financial issues reduce patients’ compliance with their cancer treatment even though that treatment is key to their recovery. Additionally, 40% of patients reported depleting their savings, almost 30% reported dealing with bill collectors, and 54% of those handling a major/catastrophic financial burden said it had become more difficult in the past year to afford treatment.

Furthermore, 68% of cancer patients and caregivers surveyed reported that the patient is experiencing financial hardship due to medical bills, and 55% of all cancer patients surveyed said the stress of dealing with costs negatively affects their ability to focus on their recovery." Thus, it is important to have not only coverage but the right coverage so you do not find out you should have looked at that coverage closer.

Don't think you need coverage because you have health insurance? Think again! The problem with health insurance is it doesn't cover all the medical expenses. "Given all of the above, is there any question as to why an increasing number of insurance companies-- Aflac, Colonial Life, Humana, and Mutual of Omaha among them—are offering supplemental policies that focus on, and attempt to reduce the costs associated with, cancer diagnosis and care? (http://www.quotewizard.com) Of course not!

What about unforeseen out-of-pocket expenses? Loss of work? Travel? Lodging? Meals away from home? These incidentals quickly add up and quickly deplete loved one's savings. One doesn't obtain car insurance, homeowners, or other insurances after something becomes an issue. So why would you treat your health any different?