#Medicare for all?

A Wholistic Approach

Certainly discussing this topic today is a sticky or controversial subject. Both sides, assuming there are only two, are very adamant for their beliefs. Years ago, I managed long term stay hotels so I was often privy to persons venting. Where there was a relationship, I got to hear his side of the issue, and I got to hear her side. Somewhere in the middle is the "true" truth! I approach most big decisions with the same mentality as the old Dragnet detective, "the Facts ma'am, nothing but the facts".

Opinions aside, one concern is the cost. It's interesting to note in this linked article, more of the GDP comes from health care in the US than in other countries. It is also interesting to note his comment that Americans are sicker than other countries. Is it fair or reasonable either to assume one size fits all? With America's uniqueness, would #Medicare for All have what it takes to execute?

What about the quality of care? While in college I worked in a hospital, also known as a teaching hospital, next to one of these "big name" clinics. Around town, people were led to believe by clinic doctors one received better care than by those not a part of the group. Well, guess what! I will never forget the words of the cardiac surgeon from the clinic deifying his skills. The "outside" but local cardiologist seemed embarrassed. The forty-seven-year-old male passed on the table. Was he ready for surgery? How could two well-trained heart doctors make such a mistake? So will the quality of care really be different as this one argument suggests?

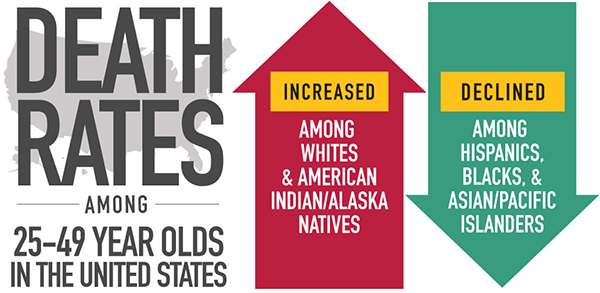

Is there another side to the "true truth"? As mentioned above in the first article, a note was made to the sickness of the American public. Why are Americans sicker than those in other countries? Is anything being done about changing these results? Is it possible to affect this issue in some way? Multiple sources have tried to sound this alarm but it seems that Americans are caught under a hypnotic trance or spell, seduction, or complete denial. In his book,# Grain Brain, Dr. Perlmutter list a smorgasbord of cognitive impairments brought on by our alleged "healthy diet". Also, William Davis, MD in his book #Wheat Belly list even more medical issues. Both and others debunk the traditional Food Pyramid. A disproportionate midsection certainly leads to other major health issues. One might not come to realize the effect of their lifestyle until their later years, however, undergoing the change in lifestyle now can extend the latter years significantly reducing the cost of medical care in the future.

Thus the final question really should be, in my humble opinion, "Do we really want care for ALL?" Or, can we find alternative ways to eliminate the need for care for many by simply re-educating the public to better care for themselves?

Thus the final question really should be, in my humble opinion, "Do we really want care for ALL?" Or, can we find alternative ways to eliminate the need for care for many by simply re-educating the public to better care for themselves?